Pre-defined best practice rules that leverage out-of-the-box industry benchmarks for accelerated deployment and reduced time to market, along with quick, accurate

evaluation of applicant’s credit worthiness.

Pre-defined best practice rules that leverage out-of-the-box industry benchmarks for accelerated deployment and reduced time to market, along with quick, accurate

evaluation of applicant’s credit worthiness.

Seamless data integration with credit bureaus for comprehensive risk profiling/ assessment, property appraisals, alternative financial data, etc.

Seamless data integration with credit bureaus for comprehensive risk profiling/ assessment, property appraisals, alternative financial data, etc.

Customisable decisioning policies for Consumer Loans (personal and home) that meet specific risk criteria.

Customisable decisioning policies for Consumer Loans (personal and home) that meet specific risk criteria.

Intuitive user interface that simplifies credit policy rules management through Policy Rule Parameters. Easy-to-navigate screens display the policy rules most likely to require

updates, making it simple for users to identify and modify key rules without needing deep technical knowledge or involving IT teams.

Intuitive user interface that simplifies credit policy rules management through Policy Rule Parameters. Easy-to-navigate screens display the policy rules most likely to require

updates, making it simple for users to identify and modify key rules without needing deep technical knowledge or involving IT teams.

Dynamic rule adjustment that lets users easily change the values and thresholds of policy rules, ensuring that lending policies remain aligned with current regulations, product

offerings, and market conditions.

Dynamic rule adjustment that lets users easily change the values and thresholds of policy rules, ensuring that lending policies remain aligned with current regulations, product

offerings, and market conditions.

Customisable decision outcomes functionality that supports strategic decision-making and helps maintain control over the credit approval process. The interface is designed to allow Credit Managers to specify target decision outcomes when a particular rule is triggered.

Customisable decision outcomes functionality that supports strategic decision-making and helps maintain control over the credit approval process. The interface is designed to allow Credit Managers to specify target decision outcomes when a particular rule is triggered.

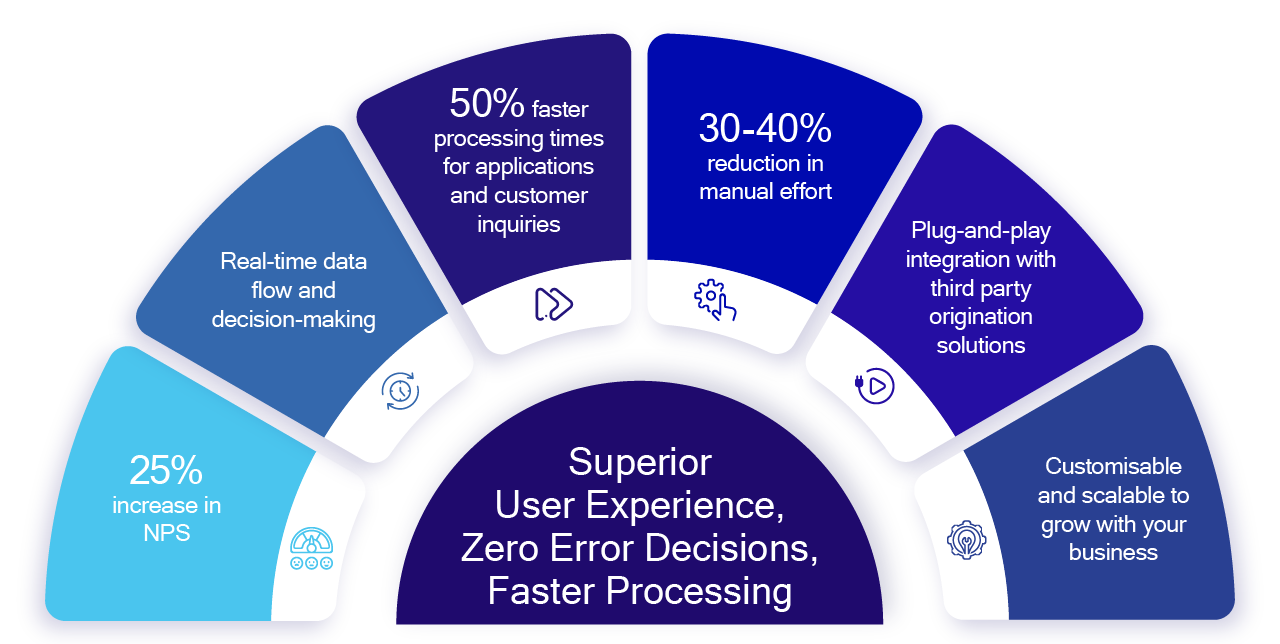

Instant credit decisions: Deliver approvals or declines of applications or trade credit requests in minutes, improving end-consumer’s satisfaction and ability to act on business needs as well as reducing drop-offs.

Instant credit decisions: Deliver approvals or declines of applications or trade credit requests in minutes, improving end-consumer’s satisfaction and ability to act on business needs as well as reducing drop-offs.

Flexible credit terms management for Trade Credit that automatically calculates and assign credit limits based on customer profiles and risk analysis with support for diverse

payment terms (including net 7, 14, 30, 60, or 90 days).

Flexible credit terms management for Trade Credit that automatically calculates and assign credit limits based on customer profiles and risk analysis with support for diverse

payment terms (including net 7, 14, 30, 60, or 90 days).