Powering the

Future of Finance

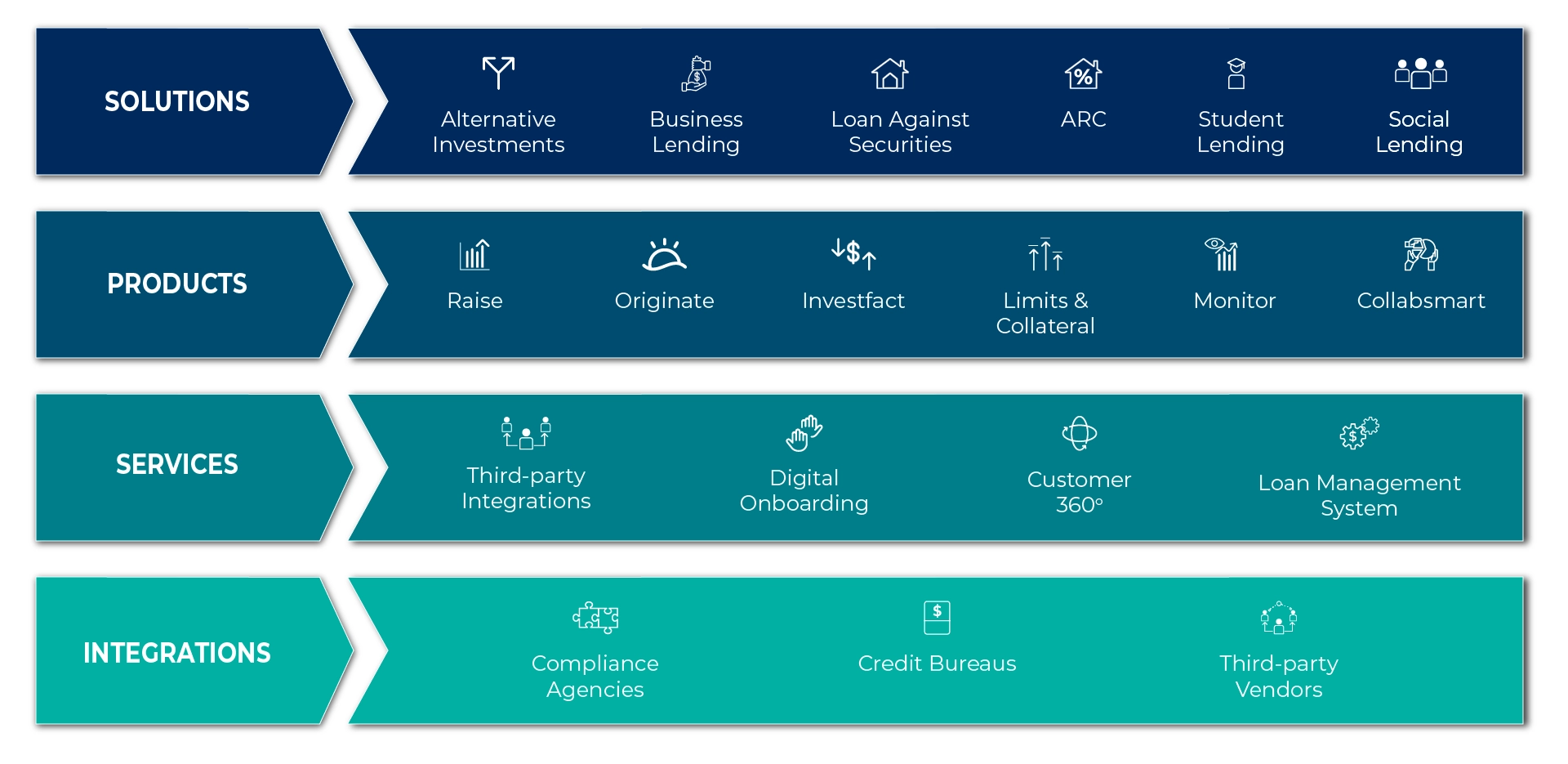

Finnate is an ever evolving cloud based platform for financial services created to accelerate innovation

A Platform Designed to Enable Financial Services Providers to Deliver Friction-free Customer and Product Lifecycle Experiences

Features

Pre-wired and highly configurable solutions to keep your business up and running at a lightning-fast speed.

A single trusted access point for adopting innovative solutions, enabling you to speed up the time to market and launch new services or products without hassles.

Complete infrastructure security with role-based checks, SSL encryption and sophisticated authentication solutions to verify customers, partners, and employees.

Real-time business intelligence, insights, and simulations for users with consolidated views of customer needs, behavior, and creditworthiness

Accelerate Innovations with Our Intelligent Technology Solutions

Collaborate like never before. Set your team up to win with Collabsmart to collaborate with your partners, regulators, and vendors across all financial stages.

Stay connected to investors with Raise to efficiently manage to fundraise, minimize friction, and inspire trust amongst partners and vendors.

Manage and automate deals with Originate, a solution that performs intelligent due diligence and helps you make data-driven decisions for successful financial deals.

You can use Originate & Raise as Salesforce apps or as independent products. What’s more? These are also available on the Salesforce app exchange.

Streamline your processes with Investfact. Its user-friendly interface meets your varying business needs with support for API and integrations and fine-tunes your loan management cycle- from disbursal to payment tracking, and risk monitoring.

Evaluate collaterals, handle limit variations and take a 360-degree customer assessment with Limits & Collateral that empowers you to make better decisions.

Mitigate risks with Monitor that helps you perform due diligence and consistent monitoring of borrowers’ assets, giving you all the information about asset health.

Finnate Takes Care of All Operations, from Raising Funds, Managing Deals and Risks to Monitoring Assets, and Accomplishing Financial Engineering.

Customers & Partners